Examples of these direct costs would be the laborers that make the product and the materials like fabric that factory workers would use to create a blanket. In terms of indirect materials, this would be a resource that doesn’t necessarily form part of the finished product. It wouldn’t be visibly obvious as a key part (and wouldn’t be present on a bill of materials). Examples could include glue, water, cleaning product or any other ingredient that has been used at some point during production. The last bit you need to think about in total manufacturing costs is your firm overhead. Understanding Total Manufacturing Costs is crucial for businesses to optimize production processes, control expenses, and make informed decisions.

Sometimes, simply making a few small changes to your routing manufacturing can result in significant savings. If you’re looking to drive efficiency in your manufacturing process, insights are key. You can make changes that streamline the process and improve efficiency by understanding how your manufacturing process works, what areas need improvement, and where bottlenecks exist. There are many reasons why more clarity around financial health is important. It helps businesses make better decisions about spending and investing. The total cost of those three expenses, or the cost of manufacturing, is $40 million.

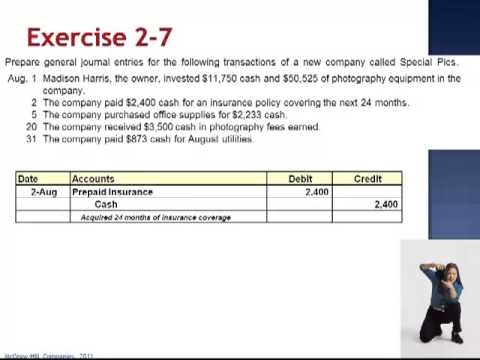

Total Manufacturings Cost = Direct Materials Cost + Direct Labor Cost + Manufacturing Overhead Cost

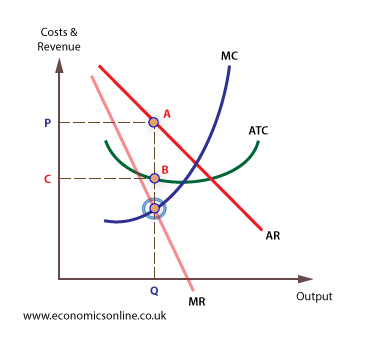

It’s necessary to keep these types of consumption separate for accounting purposes. Managers or investors can compare it to total revenue in the balance sheet to get a quick overview of the company’s profitability and adjust profit margins. Additionally, TMC can help uncover inefficiencies in the supply chain, shop floor, and inventory levels.

Cloud solutions enable you to work from anywhere, at any time, meaning you shouldn’t miss a trick when it comes to spend. But remote access aside, Manufacturing Software’s real strength comes from the fact that it unites all your business functions, allowing every employee to complete work within the same system. A fine balance must be struck, in terms of setting a price that falls within the market norm, but also retrieves an acceptable return (based on the investment that went into producing each good).

Example of total manufacturing costs

There are multiple advantages to calculating total manufacturing cost. First, having a complete understanding of these costs makes it easier to benchmark them and determine which ones can be reduced. This is an ongoing process of paring back expenses that can result in significant cost reductions over time. How does the company’s sales revenue compare to its total manufacturing costs? By understanding the total manufacturing cost formula, businesses can identify ways to reduce waste. This can lead to lower costs and a more efficient manufacturing process.

Potassium Permanganate Project Report 2023: Manufacturing Process, Business Plan & Plant Cost – Benzinga

Potassium Permanganate Project Report 2023: Manufacturing Process, Business Plan & Plant Cost.

Posted: Tue, 22 Aug 2023 08:52:44 GMT [source]

Without knowledge of COGM, it is almost impossible for a manufacturer to reduce costs and boost profitability. After calculating its COGM for the year, a business transfers the value to a completed goods inventory account. This final inventory report pertains to services, goods, and products made available to consumers. Finding this variable is easy because most organizations keep time logs for their workers. Multiply the total number of hours worked by each employee by the company’s hourly rate.

Figuring out Your Total Manufacturing Cost

It not only allows you to do critical duties such as lead generation via email, but it also provides you with a comprehensive view of your sales funnel. Deskera Books enables you to manage your accounts and finances more effectively. Maintain sound accounting practices by automating accounting operations such as billing, invoicing, and payment processing.

Also, COGM is a formula that only takes into account the costs of items that have completed the manufacturing process and have become sellable products. A company’s total manufacturing cost is the total amount of money spent by a company on its manufacturing operations, or how much it costs to produce the goods that will be sold to customers. Yet another advantage is that the cost analysis might uncover unusually large amounts of inventory obsolescence or scrap write-offs. If so, management might delve into the purchasing process, to see if inventory can be acquired and stored in smaller volumes. It might also push management in the direction of outsourcing some production activities that are generating excessively high scrap levels in-house. Either approach has the added benefit of reducing inventory storage costs, which reduces factory overhead charges.

ACTouch ERP helps to capture these data as part of Bill of Materials stage or at the time for Production Reporting stage.

For example, in a furniture manufacturing company, timber, paddings, and textile are the direct materials used in production. During the production period, Flying Pigs purchased an additional $23,200 in raw materials. At the end of the production cycle, the company had a final raw materials inventory of $17,600.

Actions that reduce costs can often streamline your processes as well. Removing steps from the production process to save money also increases efficiency, ensuring that items are created faster (which leads to greater customer satisfaction). Direct costs are normally the more flexible expenses that change depending on the amount of production taking place.

What is total manufacturing cost incurred?

Overlooking small numbers can still have a large impact that can hurt your business. ACTouch is a Manufacturing ERP Software designed for Manufacturing, Finance and Inventory features for all SMB’s businesses. Gaining accurate insight into these cost articles can be easier said than done, however.

You might be debating whether calculating your total manufacturing cost is even worth the hassle. If you put some time aside and calculate your manufacturing costs, here are five benefits you can expect to reap. Knowing what each element of your production process costs you is important. You need to understand how to split your total manufacturing cost into its constituent parts.

Thus, a portion of total manufacturing cost may be assigned to the inventory asset, as stated in the balance sheet. In the latter case, a business is manufacturing more goods than is initially demanded by customers. Once you understand the true cost of your manufacturing, you can more accurately account for inventory on your balance sheet and cost of goods sold on your income statement.

Whereas indirect costs are usually seen as more constant, as they have perhaps been fixed in advance (such as the overheads mentioned in the previous section). It costs money Total manufacturing cost to have staff in a production line and a manager to oversee them. It also costs money to offer them benefits such as retirement funds, holiday pay, and payroll taxes.

- Add direct material ($17,000), direct labor ($80,000), and manufacturing overhead ($170,000) to arrive at the total manufacturing cost for the year, which is $205,000.

- For example, nails and glue holding a wooden cabinet are indirect materials called consumables.

- The cost of goods sold can be higher or lower than the total manufacturing cost.

- Removing steps from the production process to save money also increases efficiency, ensuring that items are created faster (which leads to greater customer satisfaction).

- COGM counts only the cost of inventory that was finished and prepared for sale in the period.

Businesses include things like raw material costs, labor costs, and other overhead expenses when calculating their COGM. Total direct manufacturing cost is the sum of all costs directly attributed to producing a product, such as raw materials and direct labor. Imagine a toy manufacturer calculating the total direct manufacturing cost for a specific toy, including the cost of plastic, paint, and the wages of the workers assembling it.