Here, they’d match records like receipts or cheques with entries in the general ledger. This is a bit like carrying out a personal accounting reconciliation using credit card receipts and a statement. free invoice generator by paystubsnow When account reconciliations are incorporated into the month-end closing process, this can delay the completion of the close.

What is Account Reconciliation: Process, Example and Types

Budget controllers can keep a tight leash on spending through this match-making exercise. They’ll check that the invoices your company must pay mirror the goods or services you took delivery of. Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs.

Bank Reconciliation

Account reconciliation is typically carried out at the end of an accounting period, such as monthly close, to ensure that all transactions have been accurately recorded and the closing statements are correct. By leveraging technology for more efficient reconciliation processes, lawyers can save time and greatly reduce the chance of error. The goal of bank reconciliation is to check that ending balances match on both your bank statement and your records. Should there be any discrepancies that come up through the reconciliation process, you can then take action to resolve them.

This helps to ensure that all credit card transactions have been accurately recorded in the business’s financial records. In most cases, account reconciliations are performed against the general ledger. This is because the general ledger is considered the master source of financial records for the business. By performing reconciliations against the general ledger, the company can ensure that its financial records are accurate and up-to-date. The account reconciliation process can involve several financial accounts. Take note that you may need to keep an eye out for transactions that may not match immediately between the sets of records for which you may need to make adjustments due to timing differences.

Business Specific Reconciliation

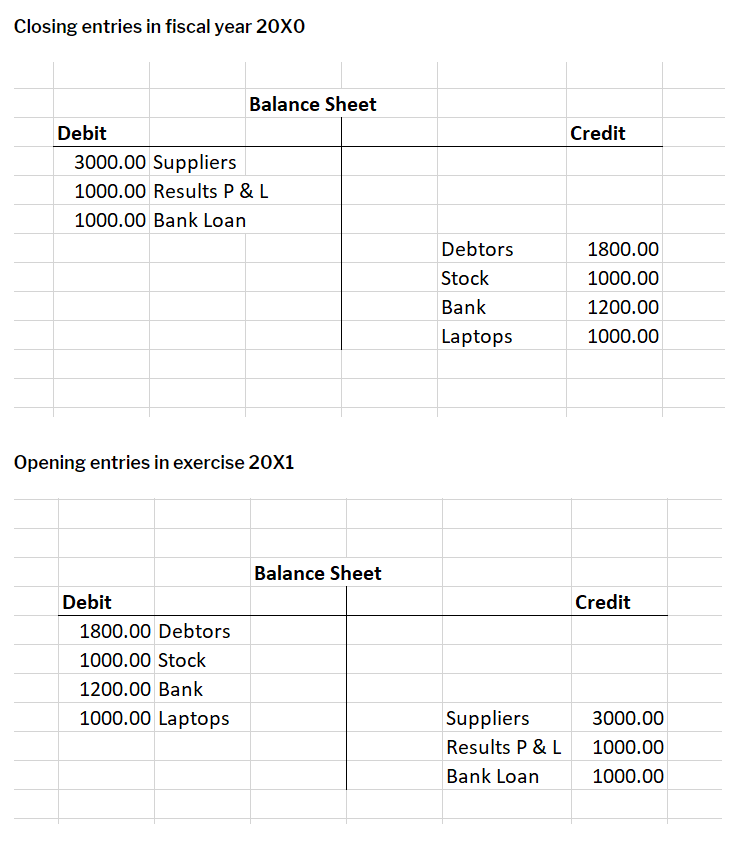

You can use different sets of figures depending on what you are trying to achieve. In business, this would typically mean debits recorded on a balance sheet and credits on an income statement. Documentation review is the most commonly used account reconciliation method.

The balances flexible budgeting nurtures your business get started with 4 best practices between the two records must agree with each other, and any discrepancies should be explained in the account reconciliation statement. The purpose of reconciliation is to ensure the accuracy and ethics of a business’s financial records by comparing internal accounting records with external sources, such as bank records. This process helps detect errors, prevent fraud, ensure regulatory compliance, and provide reliable financial information for data-driven decision-making. The very basis of double-entry accounting is itself an internal reconciliation. Transactions that impact a company’s bottom line — net income — are split between accounts on the balance sheet and the income statement.

- You would need to justify, explain, or correct any differences or discrepancies.

- But, generally accepted accounting principles (GAAP) demand double-entry accounting.

- They’ll check that the invoices your company must pay mirror the goods or services you took delivery of.

These should match up with external accounts like bank statements for month-end reconciliation. Account reconciliation is the process of cross-checking a company’s account balance with external data sources, such as bank statements. Its purpose is to ensure accuracy and consistency of financial data, which is vital for informed decision-making and maintaining financial integrity. Accounts payable reconciliation makes sure that general ledger balances match those in underlying subsidiary journals. It adheres to accrual accounting principles and reconciles balances for credit card statements to the appropriate payables account.

Manage your money and trust accounts with confidence, book your demo today. And, because Clio integrates with best-in-class accounting tools like QuickBooks and Xero, you can use them together to further simplify reconciliations. When using Clio together with these integrated accounting solutions, creating a table of values from a linear equation trust account updates made in Clio are then automatically updated in QuickBooks or Xero. Reconciliation serves an important purpose for businesses and individuals in preventing accounting errors and reducing the possibility of fraud.

Reconciliation ensures that accounting records are accurate, by detecting bookkeeping errors and fraudulent transactions. The differences may sometimes be acceptable due to the timing of payments and deposits, but any unexplained differences may point to potential theft or misuse of funds. For example, the internal record of cash receipts and disbursements can be compared to the bank statement to see if the records agree with each other. The process of reconciliation confirms that the amount leaving the account is spent properly and that the two are balanced at the end of the accounting period.